How to trade the FTSE 100

The FTSE 100 – the UK’s most popular index – offers plenty of opportunities for traders. In this guide, you’ll learn how to gain exposure to FTSE 100 price movements with cash indices and index futures, as well as ETFs.

Interested in trading the FTSE 100 with IG?

Call +44 (20) 7633 5430 or email sales.en@ig.com to talk about opening a trading account. We’re here 24 hours a day, except from 6am to 4pm on Saturday (UTC+8).

Contact us: +44 (20) 7633 5430

Trading the FTSE 100

You can gain exposure to the FTSE 100 by trading the index. Your choice may also depend on the trading hours of the index:

| Trading the FTSE 100 | |

| Ways to trade | CFDs |

| Market hours | Trade 24/7, except from 6am to 4pm on Saturdays and 6.40am to 7am on Monday (UTC+8). Please note that our Weekend UK 100 market is separate to the main FTSE 100 market. |

| Deposit required | 0.5% of trade size |

| Timeframe | Shorter term |

| Liquidity | Higher liquidity offered by trading the index |

IG also offers weekend trading hours on the FTSE 100, from 12pm on Saturday to 6.40am on Monday (UTC +8).

Trading the FTSE 100

Trading is the only way to get direct exposure to the FTSE 100’s price movements. If you want to gain exposure to the FTSE 100, you can use CFDs to speculate on price movements.

When trading, you can gain full exposure with only a small deposit (called margin) and you do not take ownership of any assets.

Investing in the FTSE 100*

When investing in the FTSE 100, you can buy shares in ETFs that track the price of the index or shares of individual constituents. Your aim will be to make a profit when you sell the shares at a later date. You could also receive dividend payments if made.

*With IG you cannot invest directly in shares or ETFs. You can however trade them via CFDs.

Ways to trade the FTSE 100

When trading with IG, you can get exposure to the FTSE 100 through CFDs by trading the following:

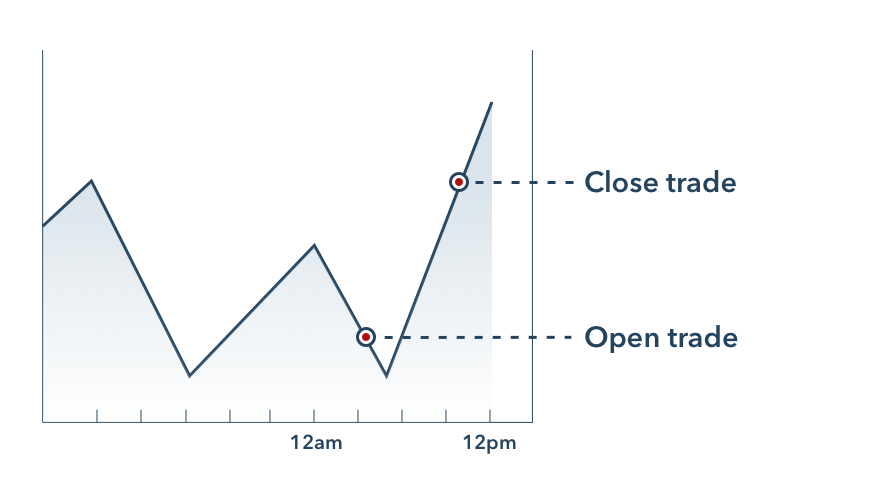

Cash indices

Trading cash indices means dealing at the current price of the underlying market. Cash indices are popular with short-term traders because they offer some of our tightest spreads. However, if you keep cash index positions open overnight, an additional funding charge will apply.

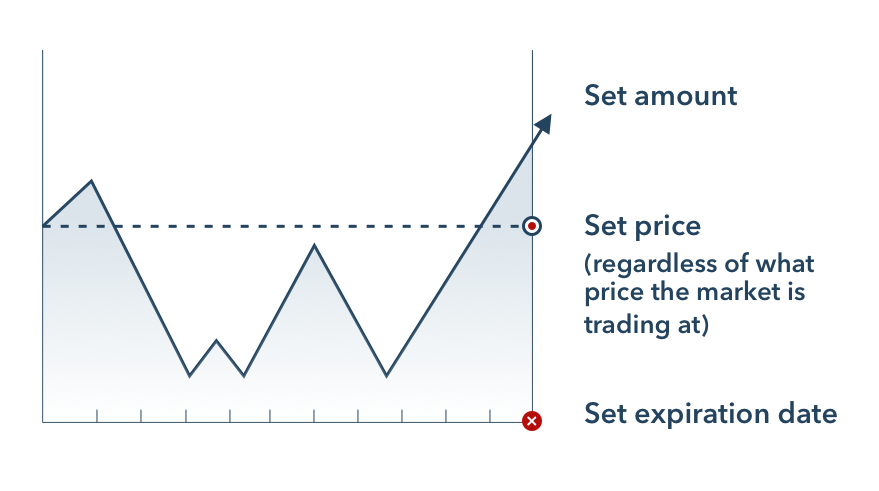

Index futures

Trading index futures means you agree to trade the index at a specific price on a specific date. Index futures are popular among longer-term traders because the overnight funding charge is included in the spread – enabling you to hold positions for a long time without this additional cost.

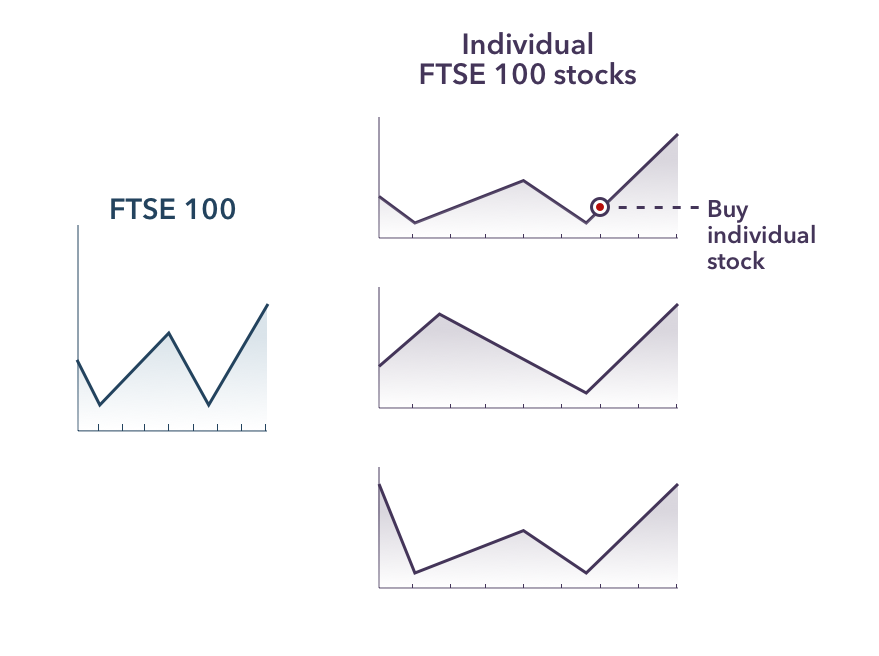

Share CFDs

You can go long or short on the share price of constituents within the FTSE 100 without owning them. This means you can take advantage of markets that fall in price as well as those that rise. If you think the share price will go up, you go long (buy) and if you think it will fall, you go short (sell). You will make a profit if the market moves in your favour.

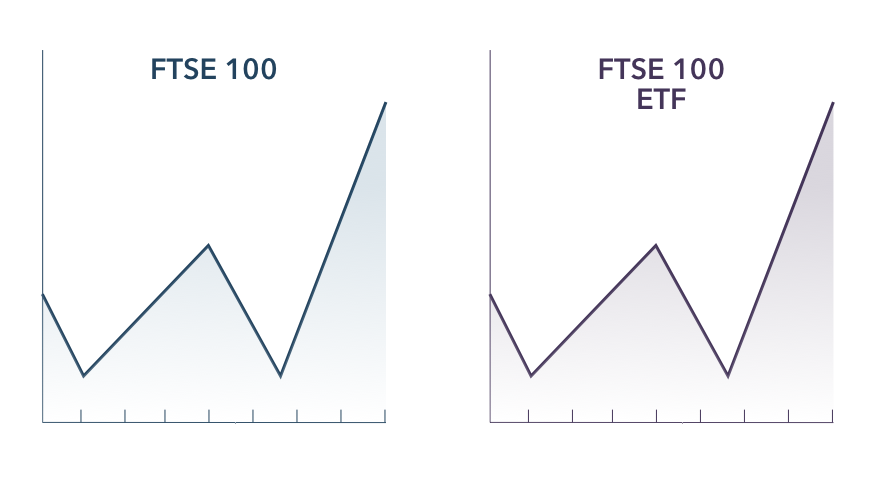

ETFs

You can capitalise on short-term price movements across all 100 companies on the FTSE 100 by trading an ETF, which imitates the composition of the index. ETFs are traded in a similar way to stocks, but they track an underlying asset or basket of assets. When you trade FTSE 100 ETFs with CFDs, you can get amplified exposure because you’re trading using leverage.

What moves the FTSE 100’s price?

The FTSE 100’s price is moved by factors including:

- Economic events - Events such as Brexit, can have a significant impact on the price of an index. Since the 2016 referendum, the FTSE 100 has tended to move inversely with the pound.

- Exchange rates - Fluctuating exchange rates can affect the FTSE 100’s price because its constituents earn a lot of their income in other countries.

- News releases - Certain news releases are generally followed by a period of volatility in the market. If the news pertains to any of the industries or constituents of the FTSE 100, its price may be affected.

- Earnings reports - Changes to FTSE constituents’ valuations can have a substantial impact on the index price, depending on the weight of the stock.

- Commodity prices - Because around 15% of companies on the FTSE 100 are commodity stocks, commodity price fluctuations can influence the index’s price quite heavily.

Traders should always use a combination of fundamental analysis and technical analysis before trading the FTSE 100, and follow their trading plan and risk management strategy.

FTSE 100 trading strategies and tips

- Decide on your trading style: There are four main trading styles – scalping, day trading, swing trading and position trading. Each trading style describes how often you place a trade, and how long you keep those trades running

- Study charts and price action: Daily and weekly charts can help you to gauge market sentiment, while price action can help you get a feel of what the market might do next

- Use technical analysis and indicators: It can be helpful to use technical analysis and trading indicators as part of your trading strategy to identify certain signals and trends within the market

- Look for FTSE trading signals: By looking at the FTSE 100 chart, you should be able to tell if it is in a trend. You can confirm trading signals with momentum indicators such as the stochastic oscillator or RSI

- Set trading alerts: Trading alerts enable you to set specific criteria for the FTSE 100 price and be notified immediately once the criteria have been met

- Follow news: Every time news about a company, such as earnings, is released, it can affect share prices. Keep a close eye on the economic calendar to help you trade according to the latest events

FTSE 100 calculation and trading hours

The FTSE 100 is an index of the UK’s largest 100 public companies by market capitalisation. It has become a popular way to gain exposure to the UK stock market and track the performance of the country’s economic health.

The market capitalisation of the index has grown significantly since its inception in 1984, as its constituents have experienced success and growth.

How is the FTSE 100 calculated?

The FTSE 100 is calculated by weighing all stocks listed on the London Stock Exchange (LSE) by market capitalisation. The 100 companies with the highest market cap make it onto the index. Companies with a higher market capitalisation will represent a higher weight in the index and stocks with higher weightings have a bigger effect on the FTSE 100’s price.

What are the FTSE 100’s trading hours?

The FTSE 100’s trading hours are 4pm to 00.30am (UTC +8). IG also offers exclusive weekend trading hours for the FTSE 100, from 12pm on Saturday to 6.40am on Monday (UTC +8).

FAQs

What are the ways you can trade the FTSE 100?

You can trade the FTSE 100 with CFDs, which are a financial derivative that mirror the underlying market price of the FTSE 100 index. CFDs can be used to go long and speculate on the price of the FTSE 100 rising, or you can go short and speculate on the price falling.

What should you know before trading the FTSE 100?

Before trading the FTSE 100, make sure you do your research and understand how the index works. Consider putting your knowledge to the test with a demo account.

How do companies get onto the FTSE 100?

To get onto the FTSE 100, a company must be listed on the London Stock Exchange (LSE) and it must be one of the top 100 companies by market capitalisation on the exchange. If its market capitalisation drops drastically, a company might lose its listing on the FTSE 100.

Develop your knowledge of financial markets

Find out more about a range of markets and test yourself with IG Academy’s online courses.

You might be interested in…

See how you can react to volatility in the markets

Discover how to trade with free online courses, webinars and seminars.

See how we've been changing the face of trading for more than 45 years.