How to trade the Taiwan Index

The Taiwan Capitalization Weighted Stock Index represents all common stocks listed on the Taiwan Stock Exchange. Find out how to trade the TAIEX with our Taiwan Index.

Start trading today. Call +44 (20) 7633 5430, or email sales.en@ig.com to talk about opening a trading account. We’re here 24/5.

Contact us: +44 (20) 7633 5430

Start trading today. Call +44 (20) 7633 5430, or email sales.en@ig.com to talk about opening a trading account. We’re here 24/5.

Contact us: +44 (20) 7633 5430

You can get exposure to the TAIEX via our Taiwan Index. To open a position, follow these three steps:

1. Decide how you'd like to trade on the index

You can get exposure to the TAIEX by trading Taiwan Index ETFs and individual shares, or trading on the index’s value.

2. Create a trading plan

Before taking a position on the Taiwan Index, decide whether you're a short- or mid-term trader – and learn how to manage your risk.

3. Open a live account

Open and fund a CFD trading – start by filling in our application form.

To help you decide how you want to trade the Taiwan Capitalization Weighted Stock Index (TAIEX) via our Taiwan Index, we explain each method in detail below.

What’s on this page?

How can you trade the TAIEX?

You can trade the Taiwan Capitalization Weighted Stock Index (TAIEX) via our Taiwan Index, which tracks the price of the underlying.

You can:

Trade the Taiwan Index price directly

- Get exposure to the performance of Taiwan’s most popular listed companies from a single position

- Take a position on the Taiwan Index, which tracks the TAIEX, using CFDs. While these are derivatives, this is the most direct way to trade on the price of the underlying – the Taiwan Capitalization Weighted Stock Index

- Access the TAIEX in a market with high liquidity

- Go ‘long’ if you think the price will rise or ‘short’ if you think the price will fall

- Trade commission-free with CFDs (excluding share CFDs) as charges are included in the spread

- Choose our Taiwan Index ‘cash’ (spot) market to take a short-term position

- Trade our Taiwan Index via futures or options for positions over the long term

- Place your deals almost 24/7 (excludes 10pm Friday to 8am on Saturday and 10.40pm to 11pm on Sunday)

Trade TAIEX-related ETFs

- Get broad exposure to the TAIEX with our linked ETFs

- Take a position on the price movements of TAIEX-linked ETFs without owning them, using CFDs

- Go long or short on ETF prices, but remember that this offers lower liquidity and higher spreads than trading the Taiwan Index itself via CFDs

- Trade on the price of the TAIEX-related ETF, calculated using the fund’s net asset value (NAV)

Trade TAIEX-listed shares

- Get exposure to specific stocks on the Taiwan Capitalization Weighted Stock Index without trading the entire index

- Take a position on TAIEX-listed stock price movements without owning the shares, using CFDs

- Go long if you think share prices will rise, or short if you think they’ll fall

- CFD share trades incur a minimum commission charge of $15

Trading the Taiwan Index price directly |

Trading a Taiwan Index ETF |

Trading TAIEX-listed shares |

|

Account types |

CFD trading account | CFD trading account | CFD trading account |

Market hours |

24/7 (except 6am to 4pm Saturday and 6.40am to 7am Monday - UTC+8) | US-listed TAIEX ETFs can be traded can be traded when the US exchange is opened between between 10.30pm to 5am Monday to Thursday and 10.30pm on Friday to 5am on Saturday (UTC+8). | When the TAIEX is open – 9am to 1.15pm , Monday to Friday (UTC+8) |

Timeframe |

Short to medium term | Short to medium term | Short to medium term |

Liquidity and execution |

0.0107 second execution speed* and unique deep liquidity | Higher liquidity offered by trading the Taiwan Index price directly | Higher liquidity offered by trading the Taiwan Index price directly |

Costs |

Trading the Taiwan Index on the spot (cash) incurs overnight fees, but index futures don’t incur these fees | CFD cash (spot) ETF trades incur overnight fees and have a minimum commission of $15 | Trade TAIEX shares that are dual listed in the US. Trade via CFDs: commission is 2 cents per share, min $15 commission |

* Correct as of 1st of February 2022. Average speed calculated from 1 to 28 February.

Overnight funding fees are charged on cash index, share and ETF positions held open after 10pm UK time (international times may vary). These fees are not charged on futures and options.1

How to start trading the Taiwan Index

Open a CFD trading account

Using our platform, you can trade the Taiwan Index with a CFD trading account.

With CFDs, you'll trade on leverage without having to own any actual shares. Instead, you’ll put down a deposit to open a larger position, with profits and losses calculated on the full position size. Leverage means both profit and loss will still be magnified to value of the full trade – so you could gain or lose money faster than you’d expect. Remeber to take steps to manage your risk.

When trading CFDs you can:

- Predict the price of stocks, ETFs and index prices rising or falling

- Leverage your exposure – you’ll only pay a deposit to get exposure to the full position size

- Take shorter-term positions

- Look to hedge your portfolio when trading

- Trade without owning the underlying asset

Because you don’t own the underlying asset, you won’t have any shareholder privileges.

Learn what moves the Taiwan Index’s price

- Economic events – China’s political and economic climate plays a big role in influencing the Taiwan Index’s price movements, as key stocks can be impacted by moderate to significant changes

- News – any global events generally have an impact on the price of an index, for example the 2019 pandemic

- Earnings reports – when constituents of the TAIEX release their earnings reports, it’s important to keep an eye on big changes to each company’s market cap. If a company has significant weight in the Taiwan Index, it can sway the index’s price

- Interest rate decisions – short-term volatility caused by interest rate decisions by major central banks can affect the Taiwan Index’s price

- Currency rates and fluctuations – the strength of currencies like TWD and RMB often have a direct impact on the performance of the companies within the Taiwan Index, as its constituents do business with countries around the world

Hone your Taiwan Index trading strategy

Follow these tips when creating your Taiwan Index trading strategy:

- Pick a trading style: decide how you want to trade the index based on your risk appetite and how much time you have. Read about the four trading styles suited to different types of traders

- Look at charts and price action: use HS50 price charts to help you determine market sentiment. It’s important to know how to use charts when trading

- Make use of technical analysis and indicators: see how technical analysis and trading indicators can help you to identify chart patterns, trading signals and trends in the markets

- Set trading alerts: set criteria for your trades and get notified when they’re met. This gives you an opportunity to act faster when you think the market price may move in a certain direction

Take your first Taiwan Index trading position

A contract for difference (CFD) is an agreement to exchange the difference in price of an underlying asset from the time it’s opened to when it’s closed.

So, however much the price of that asset has risen or dropped since you opened your position is what you stand to make as a profit or a loss.

You can trade Taiwan Index CFDs in a variety of ways.

- Cash indices: trade on the current price of the underlying market (the index) and get tighter spreads. This is popular among those with a short-term view

- Index futures: agree to trade the index at a predetermined price on a date in future. This is often preferred by those with a longer-term view

- Options: buy the right (but not the obligation) to trade the underlying at a predetermined price in future. Options are generally suited to more experienced traders with a long-term view

- ETFs: get exposure to a basket of TAIEX stocks, on the spot or using forwards, in a single position

- Shares: predict TAIEX-listed shares’ prices rising or falling without owning them

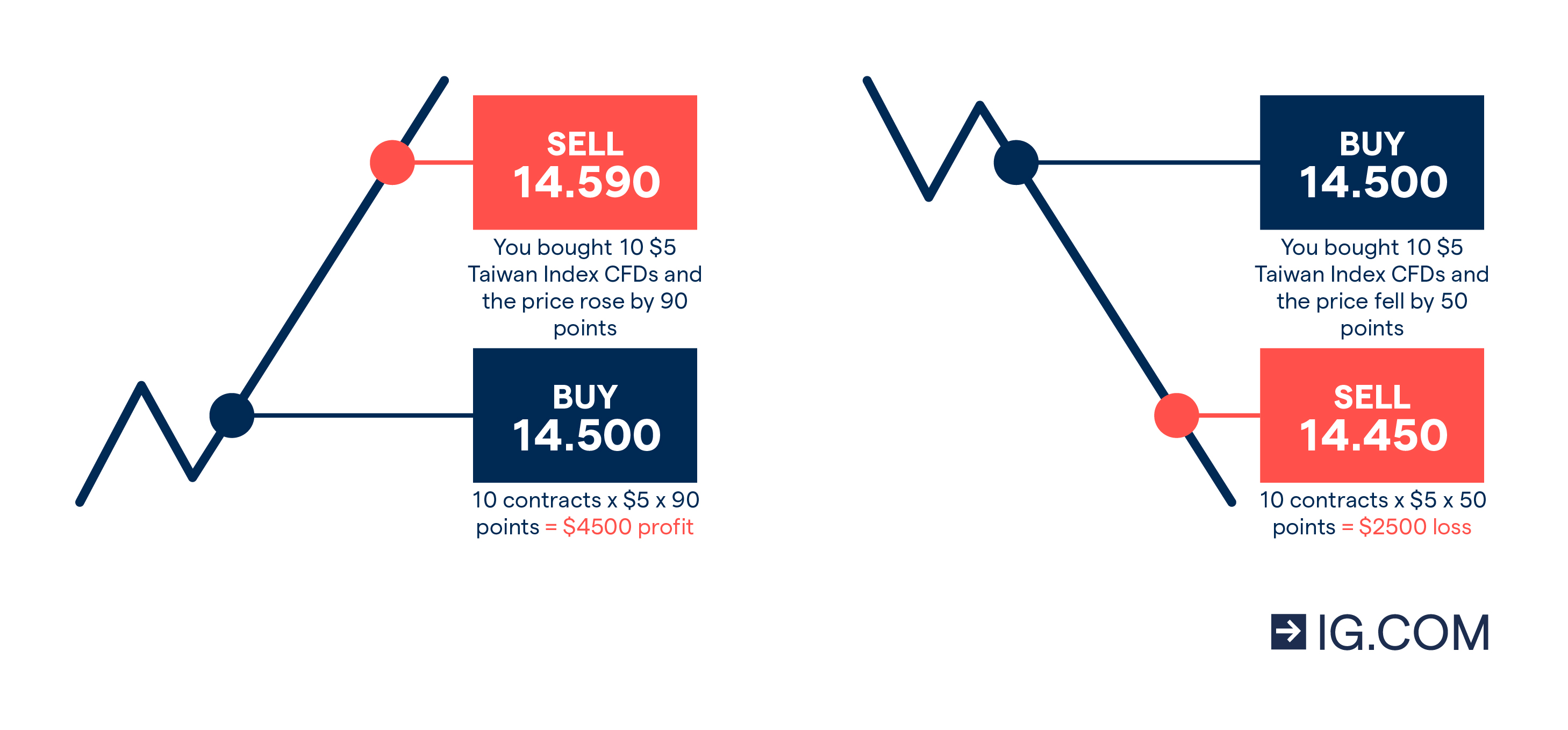

Here’s an example of how CFD trading works. Let’s say you think that the Taiwan Index price is going to rise from its current price of 14,500. You buy 10 CFD contracts on our index worth $5 per contract. If your prediction is correct, and you close your position when the sell price is 14,590. The difference is 90 points, multiplied by the $5 per contract multiplied by 10 contracts, so your profit is $4500 – excluding other costs.

If your prediction is incorrect and the market drops, and you closed your trade at a level of 14,450, your loss would be $2500 – excluding other costs.

FAQs

What are the ways you can trade the Taiwan Capitalization Weighted Stock Index (TAIEX)?

You can trade TAIEX-listed stocks or related ETFs on our trading platform. You can also get exposure to our Taiwan Index, which tracks the movements of the TAIEX.

You can trade using CFDs to take a position on the cash index, options, ETFs and shares.

What should you know before trading the Taiwan Index?

Before trading on the Taiwan Index, it’s important to do your research and understand how the index works – including how it’s calculated and what affects its price. Then, decide how you want to trade in it.

Try out our demo platform, or open a trading account if you’re ready to take on the live markets.

How is the price of the Taiwan Index calculated?

The price of the Taiwan Index is calculated by measuring the market capitalisation of all the companies listed on the Taiwan Capitalization Weighted Stock Index (TAIEX).

How do companies get onto the Taiwan Capitalization Weighted Stock Index?

The constituents of the Taiwan Capitalization Weighted Stock Index (TAIEX) are all common stocks listed on the Taiwan Stock Exchange (TWSE) - excluding Taiwan Innovation Board-listed shares. The TAIEX measures the performance of these stocks, which you can trade on via the Taiwan Index on our platform.

What are the Taiwan Index trading hours?

The Taiwan Capitalization Weighted Stock Index trades between 9am and 1.15pm UTC+8, Monday to Friday. Our indices, including the Taiwan Index, are normally available for trading 24 hours (excluding 6am to 4pm Saturday and 6.40am to 7am on Monday, UTC+8).

1 Overnight funding is the charge you pay for keeping cash CFD trades open past 10pm UK time (international times may vary); we’ll make an interest adjustment to your account to reflect the cost of funding your position. Learn more about how overnight funding is calculated.